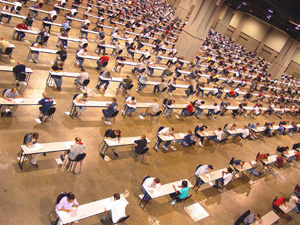

As if the bar exam isn’t stressful enough for test takers, hopeful future lawyers across the country found themselves unable to upload their first day exams after the ExamSoft servers were apparently unable to handle the massive traffic. While the issue appears to be on its way to resolution, test takers were still subjected to a tremendous amount of stress before the second part of the test. ExamSoft had years to prepare for this level of traffic and yet the system was not ready and many students suffered unnecessary stress. This situation mirrors what your loved ones will go through if you do not have a proper estate plan in place at your death, especially if your estate has to go through probate.

As if the bar exam isn’t stressful enough for test takers, hopeful future lawyers across the country found themselves unable to upload their first day exams after the ExamSoft servers were apparently unable to handle the massive traffic. While the issue appears to be on its way to resolution, test takers were still subjected to a tremendous amount of stress before the second part of the test. ExamSoft had years to prepare for this level of traffic and yet the system was not ready and many students suffered unnecessary stress. This situation mirrors what your loved ones will go through if you do not have a proper estate plan in place at your death, especially if your estate has to go through probate.

Probate is the mandatory process in Florida of validating a will (if there is one) and distributing the assets to the beneficiaries. This process usually lasts at least six months and can take substantially longer depending on the size of the estate or complexity of the assets. While the probate is going on, the estate assets are frozen while they are marshaled and prepared for distribution. Creditors are also paid off out of the estate before distribution. During this time, the presumed beneficiaries do not have access to the estate property. This can lead to financial hardship and liquidity issues for the surviving family members. Furthermore, probating an estate is costly, which continues to decrease the inheritance the beneficiaries will receive.

Whether you die with a will or not, you will still have to probate your estate if your probatable estate exceeds $75,000 (Florida’s probate limit.) A will alone is not a sufficient device for avoiding probate. The benefit of having a will is that you can decide who gets what from your estate, and you can also name a guardian, but a will does not avoid probate. To effectively avoid probate, a trust based estate plan should be used. A trust based plan avoids probate by transferring ownership from you as an individual to your living trust. You will be able to use all your assets in the exact same way, but when you die, your estate will pass to your beneficiaries without going through probate. In addition to the benefit of avoiding probate, a trust based plan also gives you as grantor increased control over who gets the assets down the road and creditor protection for your beneficiaries.

For more information on successful Florida estate planning and asset protection techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 to schedule your free consultation.

It’s a Wild world. Are you protected? SM