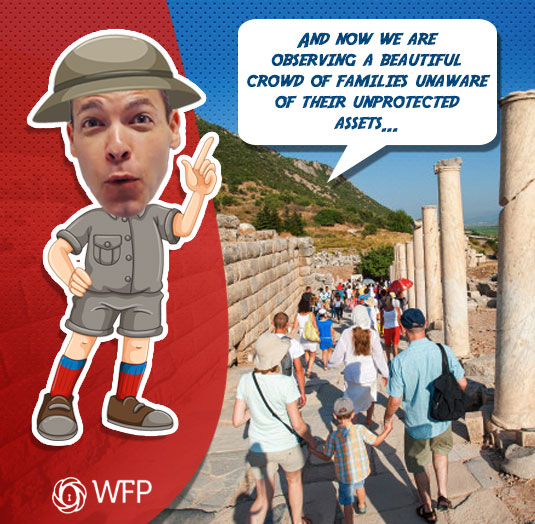

Summer is here! It’s June, which means it’s time to vacation in the sand, sun, and surf. Before you go on a vacation (and hopefully, you get to go, as the past year has been stressful for us all), it’s important to take care of some estate planning essentials. This article will serve as a guide to how to estate-plan before taking a vacation.

Why Before a Vacation?

Though vacations are fun and laid-back, the real reason that you should estate-plan before a vacation takes into account the less-fun side of things. Bad things can—but hopefully won’t—happen on a vacation. If you die or become ill or injured on a vacation, an estate plan will keep your assets and medical decisions from being taken over by third parties who don’t know you and don’t know your family.

What to Have

Below are a few legal tools and documents that you should have in your estate plan. These aren’t the be-all, end-all of estate planning, but they will get you off to a pretty good start. Though certain websites and services offer to let you write these documents yourself, it’s best to let a professional do them for you, as lawyers can best navigate the tricky legal waters.

Beneficiary Designations

Beneficiary designations on things like 401(k) and life insurance documents provide someone to receive these accounts in the event that you pass away. Usually, it’s a spouse or child who is given the money, but it can be anyone you name (if you’re divorced, make sure your ex isn’t on the account). If there’s no beneficiary named, it will likely be the court who decides who gets what.

Will or Trust

Wills and trust are two legal documents, each different in their own ways, with similar purposes. They both are designed to lay out where your assets will go if you die. You can couple these with a letter of intent, which you write to your executor spelling out your intentions for your assets. Both wills and trusts are cornerstones of asset division.

Guardianship

If you have minor children and something happens to you and your spouse on vacation, who will take care of them? Though the idea of getting eaten by a shark or contracting some random deadly disease seems far off, you never know. Name your kids’ guardians in your estate plan. Choose people who will give them the best day-to-day quality of life, and make sure you talk to your proposed guardians beforehand, as you want to make sure they are on board with such a huge, life-changing responsibility.

Power(s) of Attorney

Powers of attorneys are trusted individuals that you choose to make healthcare and/or financial decisions for you in the even that you’re unable to make them yourself. Taking from the example above, let’s say you contract a rare disease and are too sick to pay your bills. A financial POA will take care of those responsibilities for you until you are well enough to return to those tasks.

Advanced Directive

Also known as living wills, advanced healthcare directives are important documents for anyone with strong opinions about their medical care. If you have certain religious or moral wishes (such as Do Not Resuscitate) about your healthcare, you can delineate them in an advanced directive. Doctors, nurses, and specialists will rely on this document when providing you with care. The advanced directive is highly personal, reflecting what you truly want and don’t want.

What If I Don’t Have These?

Basically, not having an estate plan and running into peril will require third parties—courts—to make decisions for you. For example, if you don’t have guardianship designations set up for your kids and you die, a judge, who doesn’t know your family, will step in and make the decision for you. The court process is costly, impartial, and can seem invasive. Estate planning will help you sidestep all of that.

Though estate planning might seem like a bummer before a vacation, consider it a boring—yet necessary—part of the vacation planning process. Contact an attorney to plan out some of the documents discussed above, as the lawyer will be able to quickly sort out what you need, getting you on your way to the sand and sun as fast as possible.