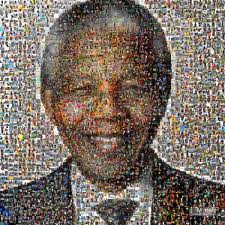

From the beloved Nelson Mandela all the way to Hitlers bodyguard, this year has waived farewell to a long list of notable deaths. As this year takes its exit, let’s look back on some of those who took their final bow in 2013:

- Charles Foley, age 82 – an inventor most well known for Patent No. 3,454,279, aka “Twister,” the innocent game of compromising positions.

- Bruce Reynolds, age 81 – the criminal who was the mastermind behind the 1963 “Great Train Robbery,” which was Britain’s largest robbery at the time (about 41 million pounds). He successfully ran for 5 years, until he was caught to serve a 25 year sentence term. Ironically enough, following his release, Reynolds lived off of income support in a London flat supplied by a charitable trust.

- Deacon Jones, age 74 – the defensive end in the NFL., best known for coining the term “sack,” as in “sacking the quarterback.” A maneuver in which he excelled.

- Chris Kelly, age 34 – the rapper of the ’90s kid rap duo Kris Kross. Kelly was known as Mac Daddy, and best known for the megahit “Jump.”

- Rochus Misch, age 96 – also known as Hitler’s bodyguard. Although he persistently denied having any knowledge of the millions of deaths caused by the Nazis, he was reportedly “the most unrepentant and unapologetic Hitler supporter you could ever have the misfortune to meet.”

- Sylvia Browne, age 77 – click here.

- Nelson Mandela, age 95 – a inspiration to millions who sought to end the oppression of more than four decades of institutionalized racial segregation. After being imprisoned as a terrorist for 27 years by a white-minority government, he united his African nation to its first multiracial democracy. He served as the country’s first black president, becoming a national emblem of racial reconciliation throughout the world.

The best take away from this year, as demonstrated by the preceding names, is to plan ahead for the unknown. You never know when your exit will take place, all you can do is have the following documents in your estate plan:

1. Living Trust – the best way to maintain control over all of your assets and distributions, while avoiding the hassle, expense, and lack of privacy associated with probate.

2. Assignment of Property – this is exactly that, assigning your property to your trust. In other words, placing your property into the trust. This includes both real & personal property. A trust does not do anything for you if there is no property in it.

3. Last Will & Testament – this is your traditional will that is used upon death to distribute property to beneficiaries, specify last wishes, and name guardians for minor children.

4. Durable Power of Attorney – this allows you to designate and authorize someone to legally act on your behalf, in the event that you become incapacitated.

5. Combination Living Will & Designation of Healthcare Surrogate – this outlines important healthcare decisions in advance, and appoints a healthcare surrogate to make healthcare decisions for you when you become unable to do so yourself.

For more information on successful Florida estate planning and asset protection techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 to schedule your free consultation.

It’s a Wild world. Are you protected?SM