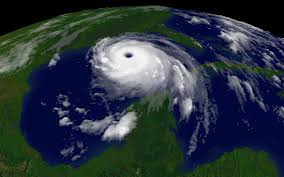

TODAY marks the eight year anniversary of Hurricane Katrina, and the destruction that befell New Orleans. It is days like these where we are reminded of the unexpected nature of devastation, recognizing that you can never be too prepared for tomorrow. In the spirit of crisis mitigation, consider whether you are prepared for the unexpected. Do you have a health care surrogate in the event that you become incapacitated? Do you have a guardian for your children? Do you have a valid will that will distribute your assets specifically according to your wishes, while avoiding unnecessary taxes or the costs associated with probate? If any of these questions are answered with a “no,” you may want to consider created an estate plan with the following documents:

TODAY marks the eight year anniversary of Hurricane Katrina, and the destruction that befell New Orleans. It is days like these where we are reminded of the unexpected nature of devastation, recognizing that you can never be too prepared for tomorrow. In the spirit of crisis mitigation, consider whether you are prepared for the unexpected. Do you have a health care surrogate in the event that you become incapacitated? Do you have a guardian for your children? Do you have a valid will that will distribute your assets specifically according to your wishes, while avoiding unnecessary taxes or the costs associated with probate? If any of these questions are answered with a “no,” you may want to consider created an estate plan with the following documents:

1. Living Trust – a living trust has become increasingly desirable due to its ability to avoid probate (the legal process of determining whether a will is valid). If you are married, you may want to designate yourself and your spouse as co-trustees, so that you have full control over the property while you are still alive. Side Note: such control does have tax consequences, so you will want to discuss this with your estate planning attorney.

2. Assignment of Property – this is exactly that, assigning your property to your trust. In other words, placing your property into the trust. This includes both real & personal property. A trust does not do anything for you if there is no property in it.

3. Last Will & Testament – this is your traditional will that is used upon death to distribute property to beneficiaries, specify last wishes, and name guardians for minor children.

4. Durable Power of Attorney – this allows you to designate and authorize someone to legally act on your behalf, in the event that you become incapacitated.

5. Combination Living Will & Designation of Healthcare Surrogate – this outlines important healthcare decisions in advance, and appoints a healthcare surrogate to make healthcare decisions for you when you become unable to do so yourself.

Hurricane Katrina is the poster child for the disaster that can transpire when you are unprepared – take a lesson from Mother Nature, and be equipped for tomorrow’s unexpected! For more information on successful Florida estate planning and asset protection techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 to schedule your free consultation.

It’s a Wild world. Are you protected?SM

E! News reports the a recent celebrity catastrophe, stating that British Airways scheduled both Angelina Jolie & Jennifer Aniston for the same flight from Los Angeles to London on Sunday. Shock! Horror! Although the airline managed to participate in some quick crisis mitigation, it begs the question: if the universe will allow Jolie & Jen to randomly schedule the same flight, what unexpected misfortune rests in the Gods of tomorrow?

E! News reports the a recent celebrity catastrophe, stating that British Airways scheduled both Angelina Jolie & Jennifer Aniston for the same flight from Los Angeles to London on Sunday. Shock! Horror! Although the airline managed to participate in some quick crisis mitigation, it begs the question: if the universe will allow Jolie & Jen to randomly schedule the same flight, what unexpected misfortune rests in the Gods of tomorrow?