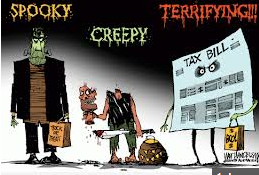

Some of the best Halloween memories come from trick-or-treating with your friends and family. When you go up to someone’s door and say, “Trick or treat!” you know that they will almost always give you candy, never a “trick” (unless you count getting raisins as a trick). When it comes to your family, you never want to leave them tricks either, but, unfortunately, that’s just what will happen if you die without an estate plan.

Probate court is the ultimate “trick,” and making your family go through that is not a fun surprise whatsoever. In this article, we’ll talk about what probate court is and how to avoid it, ensuring that your family will not get a nasty surprise after you die.

The “Tricks” in Probate Court

Estate planning has many benefits. It gives direction on where your assets should go when you pass on, and it allows you to take advantage of tax deductions and benefits so that you don’t saddle your family with the twin evils that are creditors and taxes.

Probate court is what happens when you die without an estate plan. The court manages the distribution of your assets and debts, often selling the former to pay the latter. Your family does not get anything and, if they do, they’re likely to not get it in the way in which you would prefer. Your creditors receive whatever it takes to pay off the debts. The point of probate court is to wrap an estate up by paying off debts, and it does so through an arduous, costly, and time-consuming process.

There is always the chance that the government will get your things as well, meaning that the state now owns your property and will likely sell it. These scary alternatives are what happens when you don’t have an estate plan.

Ramifications on Your Family

You may be wondering why you should care. You’ll be dead and won’t have to worry about any of this stuff; why not let the court just do it?

That’s where you’re wrong.

Your family and loved ones will be dragged into the probate process and saddled with court costs. Whoever is deemed administrator will be in charge of the process, which can take a long time. If you want to make sure that you don’t leave your family with a nightmare, create an estate plan that will give clear directions on how to manage your property, assets, and healthcare when you are incapacitated or dead. Save the tricks for Halloween, not your family.