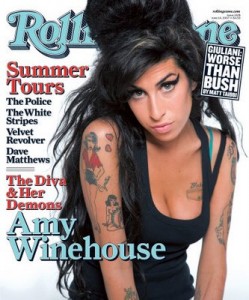

With the tragic death of singer Amy Winehouse being the trending topic right now on news outlets and social networking platforms, atleast one estate attorney could not help but wonder whether the pop-star’s estate plan was in order. After some research, it appears that Winehouse refused to be another high-profile cautionary tale of estate planning. Reports indicate that she left her estate in terrific order with all major assets protected and interest set to be distributed to where she so desired.

British law seemingly favors spouses and ex-spouses when it comes to estate inheritance after ones death. Winehouse did not wish for her assets to go to her ex-spouse, however, who is currently incarcerated. Therefore, Winehouse planned accordingly by creating a specific will that redirected her estimated 16.4 million dollar estate to her parents and brother.

While this is really seeing the silver lining of such a sad story, that positive aspect is one that always goes appreciated by a decedent’s family and loved ones as well as estate attorneys worldwide. It is always such a pleasure to hear celebrity success stories of estate planning, such as Winehouse’s, because too often it is the horror story that gets such sensational media exposure. Too often celebrities leave their estate a mess and, as a result, the world hears about how certain assets ended up in the wrong hands, how a very specific loved one received no inheritance due to statutory law, or how millions of dollars in interest in the estate were lost due to estate taxes and probate administration.

No matter how big or small your estate is there are things you can do to protect your assets and assure that your family and loved ones are taken care of. Some of the basics of a good estate plan include setting up a will, a living trust, and a power of attorney. A will gives you the opportunity to specify exactly who receives what assets. A trust can be a smart way to avoid high estate tax charges by slowly transferring funds to intended inheritors reducing the overall value of your estate. And a power of attorney allows you to appoint a trusted family member to handle your finances after you die.

These are some basic estate planning steps that every person should take whether a pop-star sensation or not. It is irresponsible to go through life without an estate plan. An ill planned estate can leave loved ones wanting and heartbroken more so than they would feel during a natural grieving process. Call a reputable estate attorney now and set up an estate plan that is right for you.

For more information on successful Florida estate planning and probate, please contact the South Florida law firm of Wild Felice & Pardo, P.A. at 954-944-2855 or via email at info@wfplaw.com to schedule your free consultation.

It’s a Wild world. Are you protected?