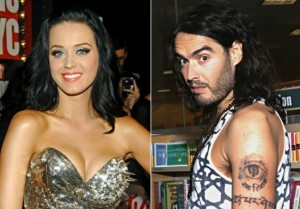

It’s not surprising that celebrity marriages melt faster than a stick of butter in a hot frying pan. So, it came as no shock after Katy Perry and Russell Brand recently called it quits. During their short marriage she was filming her movie “Part Of Me” where a camera crew accompanied her on world tours and filmed private moments with Russell.

Her ex-husband is now asking her to edit his scenes out but his requests have fallen on deaf ears. Apparently the footage reveals a not so pleasant Russell that could tarnish his public image. Maybe this is a form of retaliation on Katy’s part or maybe a healing process in letting the whole world see the real Mr. Brand.

However, the best remedial measures she can take after a painful divorce is to protect her assets. One commonly overlooked area of estate planning after a considerable life change such as a divorce, is updating one’s beneficiary designation forms. If Katy has designated Russell as the beneficiary of any life insurance policies she may have taken out or under any saving and investment plans, she should remove him. Otherwise, in the event she turn from “Hot” to permanently “Cold” with no more “Last Friday Night” excursions to sing about, the funds will be transferred to Russell’s estate. Now, that could really put a dent to an already broken heart.

It’s important to talk to your South Florida estate planning attorney on how to modify your estate plan so that your “intended” beneficiaries are accounted for so that you do not mistakenly disinherit them.

If you have family, friends or even a charitable intent, the absence of an estate plan is inexcusable. For more information on successful Florida estate planning and probate techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 or via email at info@wfplaw.com to schedule your free consultation.

It’s a Wild world. Are you protected?