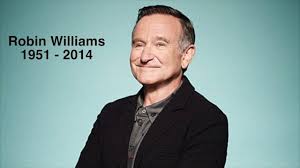

It’s not all glitz and glam once the lights turn off, something that Robin Williams’ family is quickly discovering. The beloved star, who passed away last year, is having his estate administered through probate, and fighting among family members is beginning to plague the process. Although Robin Williams had an estate plan, much of his assets were unaccounted for, leaving his children from prior marriages, and widowed spouse in disagreement over who is entitled to what. Avoid this hassle, and spare your loved ones the stress and grief that accompanies a contested probate process. It is imperative that you not only have a prepared and updated estate plan in place, but also that you speak with your family members to discuss these plans so that there are no surprised, or even worse, angered members once you’re gone.

Avoid some of the more common Estate Planning Mistakes:

Top Estate Planning Mistakes

- Thinking That You Have Plenty Of Time To Get To It: No one has a crystal ball and tomorrow is not promised to any of us. I have clients that have hired me to draft their estate plan and then they died prior to being able to sign it or fund it. There are other people who die too young to even sit with the attorney. Estate planning is necessary for everyone and you should sit with your attorney as soon in life as possible.

- Drafting Your Own Estate Plan: There are so many moving parts with a trust-based estate plan that attempting to do it yourself is the equivalent of trying to take your own appendix out. There are legal requirements in drafting, executing, funding, and updating. If you miss any of them, it could invalidate your entire plan. An estate planning attorney doesn’t sell you documents, they provide the service that goes into making sure that those documents are correct.

- Not Knowing Where All the Assets Are: A scattered estate plan by a secretive decedent may cause some assets to be left uncollected, undistributed and even lost.

- Not Updating Your Estate Plan: It is imperative that your estate plan is reviewed on an annual basis to avoid unintended results.

- Not Communicating with Trustees and Beneficiaries: It is important to let the people who are named in your estate plan know what role you are asking them to play.

- Leaving the Living Trust Unfunded: A living trust is merely a vehicle that allows you to pass your assets outside of probate. However, if there are no assets in the trust, nothing has been accomplished. You can buy the most expensive safe at the store but it wont protect your valuables unless you put the valuables into the safe.

- Leaving Assets Outright to Beneficiaries: Assets that are left outright to heirs and beneficiaries are exposed to creditors, predators and divorcing spouses.

- Not Having a Living Will: A living will gives guidelines for your physician to follow in the event you are in a terminal, end-stage, and persistent vegetative state.

- Not Having a Durable Power of Attorney: A durable Power of Attorney allows you to designate and authorize someone to legally act on your behalf, in the event that you become incapacitated.

It’s a Wild world. Are you protected?SM

For more information on successful Florida estate planning and asset protection techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 to schedule your free consultation