This Sunday most of America will be glued to television sets while watching the Patriots and Giants battle it out on the football field. Everyone will be rooting for their favorite team while wolfing down Buffalo wings and downing endless cans of beer. During commercial airtime, you might be thinking how great it is that your family and friends are all together watching the biggest game of the year. So many memories are being filled right in your family living room. You then decide you are going to leave your house to your kids so that these memories will last forever. What a great idea!

However, without careful thought, you might be doing disservice to your children in the future. If your residence is worth less than $5 million, most likely you will not have to pay any gift taxes. This is great. However, if your children decide to sell the house immediately, they will be hit with heavy capital gains tax. This is because your cost basis (whatever it cost you to purchase the house) is transferred over to the recipient. So if the fair market value of your house has substantially increased, Uncle Sam will dip into that higher gain.

However, the only way for your children to avoid such high taxes is for them to live in the house for at least 2 years before they sell it. This situation affords them the opportunity to exclude up to $250,000 from capital gain taxes.

What if you decide your children will instead inherit the real estate? In this case, the cost basis will become the current market value, which could translate into a lower gain and thus, lower taxes. However, there are estate tax consequences that will come back to haunt you. So what do you do?

Take action and consult a highly qualified South Florida attorney to learn about all the available options that can save your children from harsh taxes.

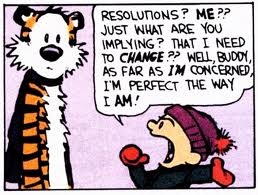

Back in 2008, the Patriot’s offensive line failed to protect their quarterback Tom Brady from the NY Giant’s hard-charging defensive linemen. Don’t fail to protect your kids from Uncle Sam’s appetite for more taxes. Put down that plate of nachos and schedule an appointment today!

For more information on successful Florida estate planning and probate techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 or via email at info@wfplaw.com to schedule your free consultation.

It’s a Wild world. Are you protected?