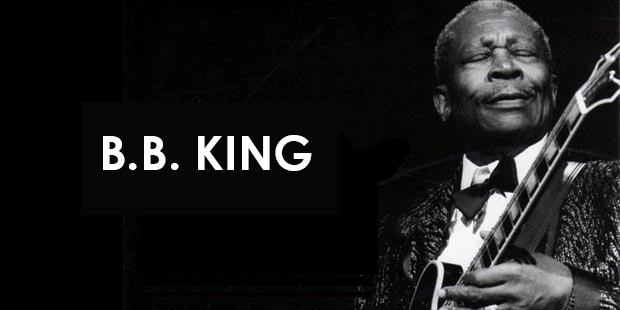

The loss of blues legend BB King has many of us feeling, well, blue. Nobody could be more upset than his children who are currently embattled in a litigation with longtime manager of BB King, Laverne Toney. In fact, three of his eleven children recently went to court to combat Toney in what they allege is a case of elder abuse.

Karen Williams, Rita Washington, and Patty King say that Toney was not providing proper medical care to their father, restricted his children and friends from visiting, and that there are large amounts of money missing from King’s bank account, to the tune of one million dollars.

Sadly, this type of fight is more common than not. When emotions are high and money is involved you never know how someone will respond. That is why it is so important to dot your I’s and cross your T’s when drafting your Will and Trust.

By having a Power of Attorney, BB King avoided the need for a formal Court-ordered Guardianship when he was older and his mental health was failing. On the other hand, the risk of using a power of attorney is that those with power can sometimes abuse it. The case in point for BB King’s children.

It is critical to work with an attorney well versed in the areas of estate planning and guardianship to make the entire process less stressful. By having the right person to guide you through the process, everyone benefits in the end. The Thrill May Be Gone but the legacy can live on.

In order to make it easy for your loved ones to say goodbye, you should consult the estate planning attorneys of Wild Felice & Partners, P.A. who can recognize potential pitfalls and how to avoid them.

It’s a Wild world. Are you protected?

For more information on successful Florida estate planning and asset protection techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 to schedule your free consultation.