The Summer Olympics, for the first time in an extremely long time, were postponed in 2020 as the world huddled from the coronavirus pandemic. Now that things are reopening and becoming more safe, especially thanks to the hard work of doctors, nurses, and researchers, the Olympics are back on!

They’re scheduled to take place Friday, July 23, 2021 through Saturday, August 8, 2021 in Tokyo, Japan. People are hyped over the Games, especially since we’ve been waiting for them an extra year. There will be fans there, but capacity is limited at 50%.

Postponement, limited capacity, and more reveal just how much life can change in an instant. What we think will last forever ends up just being a temporary feature in our lives. That’s right, we’re talking about the D-word: Divorce.

Divorce: The Facts

Few things take as much of a hard left turn as divorce. The statistics on marriage certainly look bleak, and the APA says that 40-50% of first marriages end in divorce. Second and third marriages fare even worse. Divorce is one of the most stressful things you can do, both financially and mentally.

Financially, ending a marriage in Florida costs $13,500 if you have no kids (StateLaws.FindLaw.com). If you have kids, the average cost is $20,300 (StateLaws.FindLaw.com). Though this could be more or less expensive, depending on the issues that need to be resolved and the process of resolving them, divorce almost always costs in the thousands.

Divorce and Estate Planning

Divorce affects pretty much every aspect of your life, and that includes your estate plan. It’s a major life change, and you have to make sure that your estate plan reflects it. Taking your ex-spouse out of your estate plan is a must do. When you got married, you likely created an estate plan that involved your spouse. Now, it’s time to undo that.

Revising Your Will

You’ll want to remove provisions that benefit your ex-spouse, and take your ex-spouse off the will as trustee and executor, assuming that you had them in that role. Make sure your ex doesn’t get any of your assets after you die, and don’t allow them control over your trust or estate.

Update Power of Attorney

If you don’t want to be married to them, chances are, you don’t want them making decisions regarding your finances and healthcare if you’re too incapacitated to do so. If your old PoA named your ex to that position, revoke it. You can execute a new PoA, naming a relative, friend, advisor, or just someone you’re not divorcing.

Update Healthcare Proxy

There aren’t many people who would want their ex making decisions about their end-of-life care. If you had your spouse listed in a proxy position for those healthcare decisions, take them off that list and replace them with a non-hostile party.

Rethink Guardianship (If Necessary)

Sometimes, in a divorce, your spouse isn’t just a bad spouse—they’re a bad parent, too. If that’s your feeling about your spouse, you might want to name someone else as the guardian of your kids if something happens to you. For example, if your divorce is caused by your spouse’s substance abuse, they’re no who you would want as a guardian for your kids if you die. This will likely be a litigated issue that extends beyond estate planning. It’s very important to talk to a lawyer if this sounds like the situation you’re experiencing.

Consider a Trust

If you don’t have a trust for your minor kids, that means that, if your ex is the kids’ guardian, he or she will have control over the kids’ finances until they reach majority (age 18). If you set up a revocable trust or a similar instrument, you can choose a trustee that isn’t your ex to control and access the money on your kids’ behalf if you die.

Life Insurance

You might have an obligation to maintain your life insurance under the divorce agreement. Review this with your estate planning attorney to avoid litigation in the future.

Beneficiary Designations

Last but not least, don’t forget to take your ex-spouse off your retirement plan beneficiary designations. Your 401(k) or IRA designations should be consistent with the terms of the divorce agreement between you and your ex.

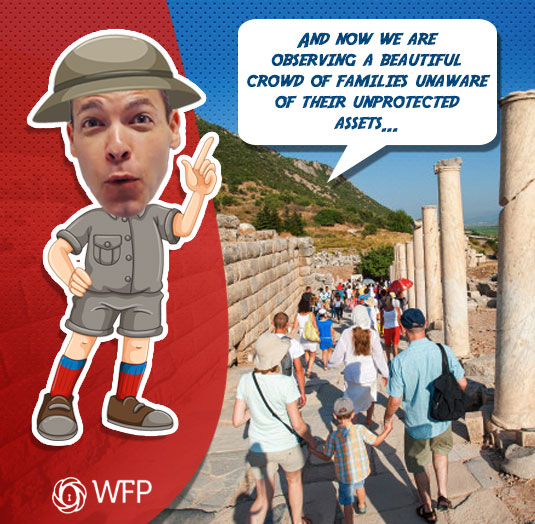

The bottom line is that you need to include an estate planning attorney and maybe even a financial advisor, in addition to your divorce lawyer. Don’t let this estate planning update wait. Place it at the top of your priority list. Schedule an appointment with WFP today.