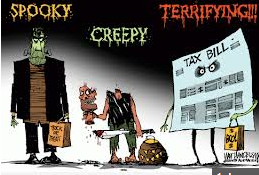

If you’re a South Floridian who loves to get spooked you probably gravitate towards haunted attractions, horror films, and gory costumes. We have something even more frightful up our sleeves that will give you a truly horrifying experience! You can live through your very own Halloween nightmare tale filled with accidental disinheritances, exorbitant taxes, and expensive probate litigation! You can watch small businesses collapse and witness the squandering of modest and large family fortunes right from the grave… when it’s too late! However, for those of us who don’t like to get scared and rather play on the safe side, here are some tips on preventing an “All Hallows’ Eve” of the estate.

First, do not erroneously assume your spouse, close friend, or even pets will be taken care of. You must specifically include your loved ones in your estate. Second, consider asset protection. It’s important to protect your beneficiaries from lawsuits, failed marriages, disability and wasteful spending. Finally, don’t do it all yourself. These do-it-yourself estate plans can create more problems than they solve. People title assets without understanding the legal ramifications behind it. There are risks and contingencies that need to be accounted for and only your South Florida attorney can help you with that.

To avoid another episode of “tales from the crypt,” it’s crucial to update your estate plan in the event of divorce. You should change the beneficiary designation form on your life insurance policy otherwise your ex-spouse will receive the proceeds. You should also account for any minor children in your will by appointing a guardian in the event you pass away. Otherwise, your children could end up wards of the state!

If you have family, friends or even a charitable intent, the absence of an estate plan is inexcusable. For more information on successful Florida estate planning and probate techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 or via email at info@wfplaw.com to schedule your free consultation.

It’s a Wild world. Are you protected?