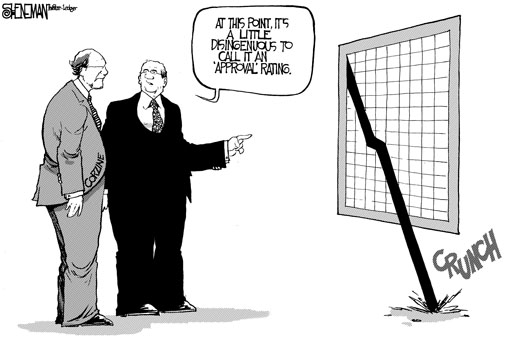

Just when we were about to lose faith in our government, Congress finally settled on a deal that ended the infamous 16-day shutdown. The good news – there will be no default on the national debt. The bad news – American’s are not very fond of Congress. In a poll from Public Policy, Congress’ approval ratings were compared to a variety of those of the less desirable kind. The following won over Congress : hemorrhoids (53%-31%), jury duty (73%-18%), toenail fungus (44%-41%), cockroaches (44%-42%), the IRS (42%-33%), the respondents’ mothers-in-law (64%-20%), potholes (47%-36%) and zombies (43%-37%). However, congress did have better approval ratings than Russian President Vladimir Putin, former congressman Anthony Weiner, Lindsay Lohan, and Honey Boo Boo.

Just when we were about to lose faith in our government, Congress finally settled on a deal that ended the infamous 16-day shutdown. The good news – there will be no default on the national debt. The bad news – American’s are not very fond of Congress. In a poll from Public Policy, Congress’ approval ratings were compared to a variety of those of the less desirable kind. The following won over Congress : hemorrhoids (53%-31%), jury duty (73%-18%), toenail fungus (44%-41%), cockroaches (44%-42%), the IRS (42%-33%), the respondents’ mothers-in-law (64%-20%), potholes (47%-36%) and zombies (43%-37%). However, congress did have better approval ratings than Russian President Vladimir Putin, former congressman Anthony Weiner, Lindsay Lohan, and Honey Boo Boo.

If you, like the respondents in the above poll, are not so fond about the idea of leaving your future in someone else’s hands – the following five estate planning documents will ensure that your future-planning receives a better approval rating than the cockroaches and zombies.

1. Living Trust – a living trust has become increasingly desirable due to its ability to avoid probate (the legal process of determining whether a will is valid). If you are married, you may want to designate yourself and your spouse as co-trustees, so that you have full control over the property while you are still alive. Side Note: such control does have tax consequences, so you will want to discuss this with your estate planning attorney.

2. Assignment of Property – this is exactly that, assigning your property to your trust. In other words, placing your property into the trust. This includes both real & personal property. A trust does not do anything for you if there is no property in it.

3. Last Will & Testament – this is your traditional will that is used upon death to distribute property to beneficiaries, specify last wishes, and name guardians for minor children.

4. Durable Power of Attorney – this allows you to designate and authorize someone to legally act on your behalf, in the event that you become incapacitated.

5. Combination Living Will & Designation of Healthcare Surrogate – this outlines important healthcare decisions in advance, and appoints a healthcare surrogate to make healthcare decisions for you when you become unable to do so yourself.

For more information on successful Florida estate planning and asset protection techniques, please contact the South Florida law firm of Wild Felice & Partners, P.A. at 954-944-2855 to schedule your free consultation.

It’s a Wild world. Are you protected?SM